This is the starting point for those couples who are:

>> already living together or planning to live together;

>> already married or planning to get married.

You might be in a marriage or a de facto relationship, but the defining factor is you want to stay together and live happily ever after.

Whatever the case, even with the best intentions sometimes relationships do breakdown and if that should happen to you this document will provide a clear understanding of how property should be divided and quarantine specified assets from claim.

As unromantic as it might sound, the reality is something like 40% of first-time marriages will fail within 10 years, and there is nothing to suggest de facto relationship fare any better. And the statistics don’t improve the chances for 2nd or 3rd relationships.

I’m not trying to sound negative, but from a totally pragmatic viewpoint, if you knew that there was a 40% chance that your house would burn to the ground within 10 years, wouldn’t you want to insure against this possibility? or at least have an exit plan?

Well that’s all a financial agreement is – it’s an insurance policy just in case. We all hope and plan for the best of times but we insure against the worst.

Couples of all ages make financial agreements for all sorts of reasons.

For example, one or both partners:

The reasons are many and varied, but the one consistent message is to provide peace of mind for those who feel they may be at risk of losing their financial security.

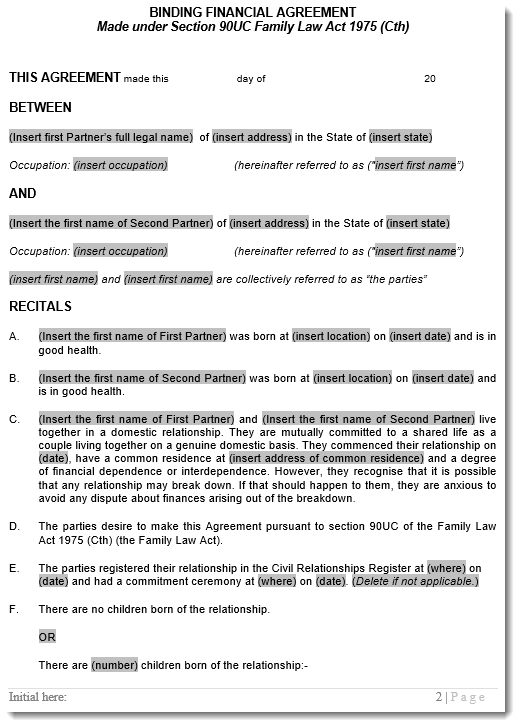

This is a sample of the defacto cohabitation agreement. You’ll choose the agreement for your circumstances once you get to the members area.

Buy Financial Agreement for Continuing relationship – Instant Download

It’s a tool that deals with the fear that you might lose your financial security and offers you a way to set aside misunderstandings over “who might be entitled to what.”

It’s a way to gain peace of mind by dealing openly with the financial “what if’s” which often removes the source of persistent arguments.

The material in our kit covers all of the issues that may be of concern to any couple who want to define “what should happen if things don’t go to plan”.

We’ve developed our unique process over several years, and our Australian Legal team will ensure you have a compliant financial agreement that provides the sound legal protection you seek.

This includes the mandatory Legal Advice that you MUST receive before signing your financial agreement. Make sure you click on the Legal Advice tab above to get the full story on this before you make your purchase.

Our unique process gives you the tools and the confidence you need to finalise your financial agreement with a minimum of stress.

We will show you what you need to do, and explain why you need to do it, so your agreement will be strong and stand the test of time.

Our role in the Peaceful Path to Settlement doesn’t stop once you download the agreement. We are your safety net and guiding hand.

In a nutshell – we work with you from start to finish. From the moment you download your agreement to the final signature. We know our stuff, our systems are finely tuned and our customers love us for it!

“The service provided by your company was second to none! The prenuptial contract process was seamless with all the details that I wanted plus more. The service, support, the contract, examples contract and everything that came with it was faultless! I highly recommend your company and will with no hesitation use your service again! Well Done.”

Nathan Waterstone

Oakleigh Vic

If you do decide to download a document from the internet, only a document drafted to comply with Australia’s Family Law Act and reviewed by an Australian lawyer will protect you. If you can’t speak in person to the staff of the company making the offer. Proceed with caution.

On the other hand if you want to speak with us, all you have to do is pick up the phone and call 1800 608 088.