OK, so now we know you need a de facto separation agreement with super split provisions. Read on...

Ending a long term relationship is never easy and there can be much emotional and financial fallout as the couple negotiate the separation process.

By law, de facto couples are not required to formally document the end of the relationship. You can just divide any assets or property between yourselves, and move on with your life.

However, such arrangements leave the door wide open for either party to make a future application to the family court for financial orders, essentially taking a second bite of the cherry.

Our lawyers drafted the following agreement specifically for a separated de facto couple who need to include super splitting in their property settlement.

It includes all of the normal provisions or clauses you will find in our 90UD binding financial agreement with the addition of clauses that deal with the splitting of superannuation assets. These extra clauses detail your instructions to the super fund trustee about how the couple wish to divide their superannuation entitlements.

Superannuation is special kind of asset which falls under superannuation laws like the SIS Act (Superannuation Industry Supervision Act). Payments made from one party to the other must be retained in an “approved deposit fund” until retirement age and therefore, are not normally available as cash.

You may have one or more funds you wish to split, but generally people will only split one fund, as it can get somewhat complicated and expensive if you are trying to coordinate more than one fund and trustee.

We’ve drafted this document to make dealing with the superannuation splitting component of your agreement as painless as possible. You can express how you wish to divide the funds, either as a percentage (eg. 60% / 40%), or as a nominated sum (eg. $60,000). This amount should be transferred or rolled over to the other party’s super fund.

You simply need to use one of the two document templates provided in this kit.

Some of these issues may seem a little daunting at first, but given the right template to start, some sample clauses and a little guidance, you will be surprised how straight forward it actually is.

Common property settlement issues include:

It’s useful to know that even though most separated couples live apart in separate residences, the Act does provide for a couple to be classed as separated even though you may be living together under the one roof. So you can still take care of the property settlement issues and live under the same roof.

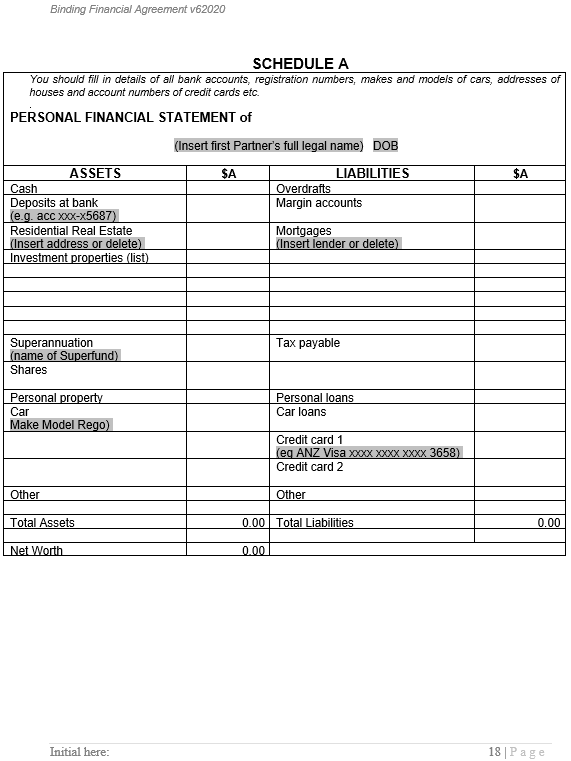

You enter your assets and liabilities onto the schedules – one for each party, and one for jointly held property.

Choose from industry or SMSF Fund – Just $

Buy Separation Agreement Super Splitting – Instant Download

Buy Separation Agreement Super Splitting SMSF – Instant Download

Our unique process gives you the tools and the confidence you need to finalise your property settlement with a minimum of stress.

We will show you what you need to do, and explain why you need to do it, so your agreement will be strong and stand the test of time.

Our role in the Peaceful Path to Settlement doesn’t stop once you download the agreement. We guide you every step of the way.

[add_to_cart id=”1007″]

In a nutshell – we work with you from start to finish. From the moment you download your agreement to the final signature. We know our stuff, our systems are finely tuned and our customers love us for it!

“The Separation Agreement template was easy to complete and the lawyer allocation process was fast and efficient. I would recommend this service to anyone who has a straightforward separation and needs the Agreement to satisfy the bank. 10/10 for your service!”

J Whittaker

If you do decide to download a document from the internet, only a document drafted to comply with Australia’s Family Law Act and reviewed by an Australian lawyer will protect you. If you can’t speak in person to the staff of the company making the offer. Proceed with caution.

On the other hand if you want to speak with us, all you have to do is pick up the phone and call 1800 608 088.